What is DeFi and How Does It Work?

Decentralized Finance, commonly known as DeFi, is a rapidly growing sector within the cryptocurrency industry. It aims to revolutionize traditional financial systems by providing open and permissionless access to various financial services. Unlike traditional finance, which relies on intermediaries such as banks and brokers, DeFi operates on blockchain technology, enabling peer-to-peer transactions without the need for intermediaries.

The Basics of DeFi

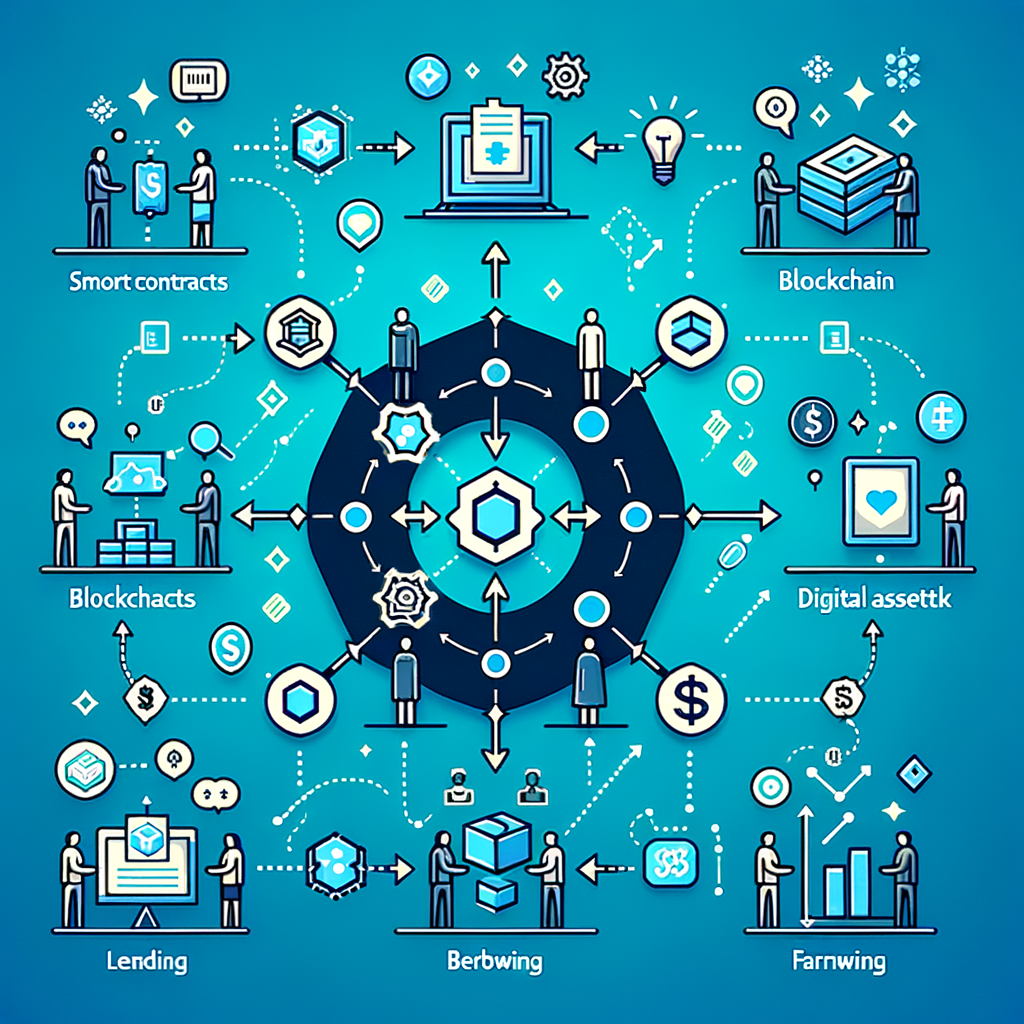

DeFi encompasses a wide range of financial applications and services, including lending, borrowing, trading, insurance, and more. These services are built on decentralized platforms, primarily using smart contracts, which are self-executing contracts with predefined rules and conditions.

One of the key features of DeFi is its open and transparent nature. All transactions and activities are recorded on a public blockchain, ensuring transparency and immutability. This eliminates the need for trust in centralized authorities and allows anyone to verify and audit the transactions.

How Does DeFi Work?

DeFi applications are built on blockchain platforms, with Ethereum being the most popular choice due to its smart contract capabilities. Let’s explore some of the key components and concepts that make DeFi work:

Smart Contracts

Smart contracts are the building blocks of DeFi applications. They are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute when the predefined conditions are met, eliminating the need for intermediaries.

For example, in a decentralized lending platform, a smart contract can be created to automatically lend funds to borrowers when they provide sufficient collateral. The contract holds the collateral until the borrower repays the loan, ensuring the security of the lender’s funds.

Decentralized Exchanges (DEX)

Decentralized exchanges are platforms that allow users to trade cryptocurrencies directly with each other without the need for intermediaries. These exchanges operate using smart contracts to facilitate the trading process.

Unlike traditional exchanges, which require users to deposit their funds into centralized wallets, DEXs allow users to retain control of their funds throughout the trading process. This reduces the risk of hacks and provides users with greater security and privacy.

Lending and Borrowing

DeFi platforms also enable users to lend and borrow cryptocurrencies without the need for traditional banks. These platforms connect lenders and borrowers directly, allowing them to set their own terms and interest rates.

For instance, a user can lend their idle cryptocurrencies on a lending platform and earn interest on their holdings. On the other hand, borrowers can use their crypto assets as collateral to secure loans, even if they don’t have a credit history.

One example of how cryptocurrency lending platforms work is by allowing users to lend their idle cryptocurrencies and earn interest on their holdings. This provides an opportunity for individuals to make their digital assets work for them, rather than letting them sit idle. On the other hand, borrowers who may not have a credit history or access to traditional financial institutions can leverage their crypto assets as collateral to secure loans. This opens up new avenues for individuals who may not have had access to financial services before, providing them with opportunities to meet their financial needs using their crypto holdings. This decentralized and inclusive approach to lending is one of the many ways in which cryptocurrencies are revolutionizing the financial industry.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve asset, such as a fiat currency or a basket of assets. They play a crucial role in DeFi by providing stability and reducing the volatility associated with other cryptocurrencies.

Stablecoins enable users to easily move in and out of cryptocurrencies without relying on traditional banking systems. They also serve as a medium of exchange within DeFi platforms, allowing users to transact without being exposed to the price fluctuations of other cryptocurrencies.

Benefits and Challenges of DeFi

Benefits of DeFi

- Accessibility: DeFi provides financial services to anyone with an internet connection, regardless of their location or background.

- Transparency: All transactions and activities are recorded on a public blockchain, ensuring transparency and accountability.

- Security: DeFi platforms leverage blockchain’s security features, making them resistant to hacks and fraud.

- Financial Inclusion: DeFi opens up financial services to the unbanked and underbanked population, who may not have access to traditional banking systems.

Challenges of DeFi

- Regulatory Uncertainty: DeFi operates in a relatively unregulated space, which can lead to uncertainty and potential risks for users.

- Smart Contract Risks: While smart contracts are designed to be secure, they are not immune to bugs or vulnerabilities, which can lead to financial losses.

- Scalability: As DeFi gains popularity, scalability becomes a challenge, as blockchain networks may struggle to handle the increasing number of transactions.

- User Experience: DeFi platforms can be complex and challenging for non-technical users, hindering mainstream adoption.

Conclusion

DeFi is revolutionizing the financial industry by providing open and permissionless access to various financial services. Through the use of blockchain technology and smart contracts, DeFi platforms enable peer-to-peer transactions without the need for intermediaries. While DeFi offers numerous benefits, it also faces challenges such as regulatory uncertainty and scalability. However, as the technology continues to evolve, it has the potential to reshape the financial landscape and empower individuals worldwide.

For more information on DeFi and other financial insights, be sure to check out our other relevant blogs and articles available on our website. Only You Can Hold You Back!